History may be repeating itself. Updated data from the Oklahoma Energy Index (OEI) shows industry activity is beginning to follow similar patterns to the 2008-09 recession-driven retraction of Oklahoma’s energy industry.

Seven years ago, falling oil and natural gas prices sent the Energy Index downward from June of 2008 until September of 2009. Today’s Index readings are following a similar path after six consecutive months of contraction.

“Oklahoma’s energy industry is familiar with the ebbs and flows of commodity prices,” said Chris Mostek, Senior Vice President of Energy Lending for Bank SNB. “The state’s oil and natural gas producers have a proven history of weathering economic uncertainties. Although the trend is similar to the industry contraction in 2009, the lack of a global recession gives hope that the end may be sooner rather than later.”

The energy index is a comprehensive measure of the state’s oil and natural gas production economy established to track industry growth rates and cycles in one of the country’s most active and vibrant energy-producing states. The OEI is a joint project of the Oklahoma Independent Petroleum Association (OIPA), Bank SNB and the Steven C. Agee Economic Research and Policy Institute.

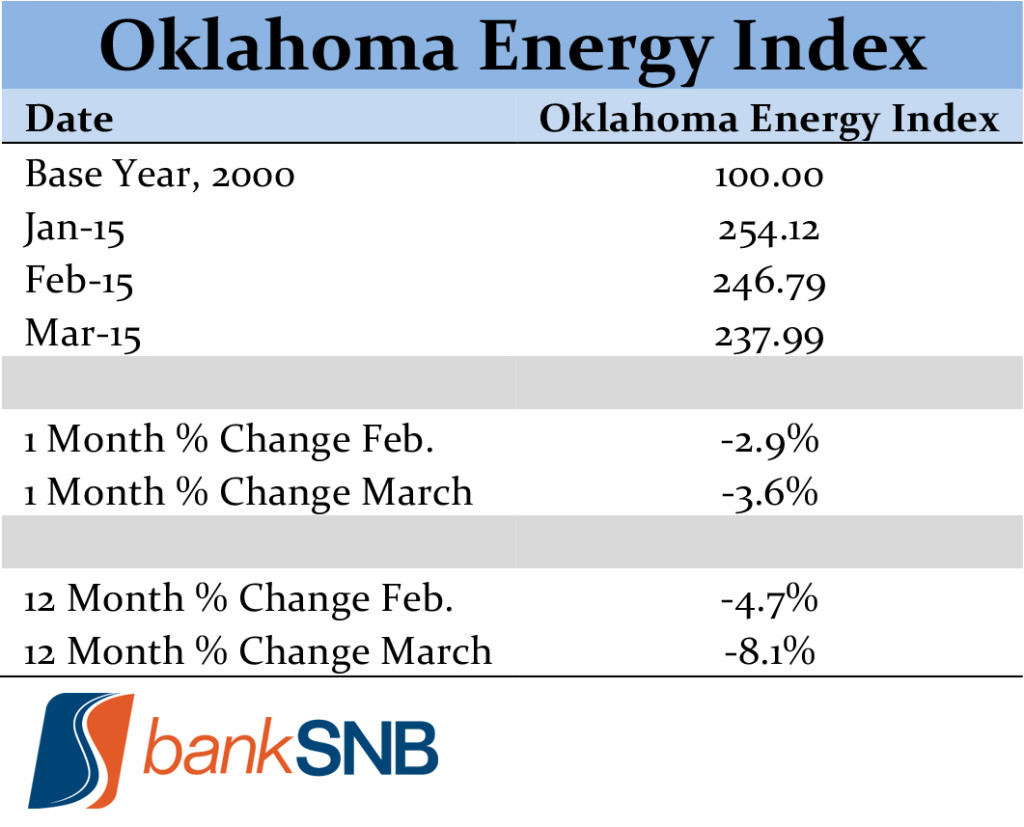

The index of oil and natural gas industry activity fell to 237.99 using data collected in March, a 3.6 percent decrease from the previous month’s reading and 8.1 percent below March 2014 levels.

“Crude oil prices have, at least temporarily, stabilized and moved slightly higher,” said Dr. Russell Evans, executive director of the Steven C. Agee Economic Research and Policy Institute. “However, rig activity continues to decline and job losses will continue to move through the industry in the short term. Only time will reveal the extent and duration of industry contraction and the severity of the ripple effects through the broader economy.”