January 3rd, 2013

Services Saturday For Horace Rhodes

Insurance Department The Oklahoma Insurance Department is mourning the loss of former Deputy Insurance Commissioner Horace Rhodes. Rhodes, 86, died Tuesday after a… 0

Miller: Pace Of Recovery Slows, But Growth Continues

Treasurer’s Office Oklahoma’s economy continued to grow, but the pace of recovery slowed during 2012, State Treasurer Ken Miller said today as he… 0

What Lots Are Thinking…

Lankford Casts Solitary Vote Against ‘Fiscal Cliff’ Deal

http://blog.newsok.com/politics/2013/01/02/rep-james-lankford-only-oklahoman-voting-against-fiscal-cliff-deal/

The Oklahoman Again Torches Fallin Over Secret Emails

Editorial The Oklahoman Less obfuscation: Gov. Mary Fallin preached openness when she took office two years ago. She ought to follow up on… 1

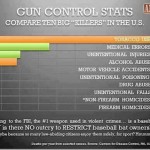

Gun Sales Set New Record, Up 49%

Reuters The number of FBI background checks required for Americans buying guns set a record in December, indicating that more people may purchase… 0

Any Questions?